Description

Investment Loan

This calculator helps illustrate the effect of using a loan to purchase an investment or appreciable asset. Using debt as leverage to purchase investments can magnify your return. The downside is that you also increase your risk. For example, if your investment were to lose all of its value you would not only have lost your investment but you would still owe the balance on the loan.

Loan Basics for Borrowers

Interest Rate

Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees. The rate usually published by banks for saving accounts, money market accounts, and CDs is the annual percentage yield or APY. It is important to understand the difference between APR and APY. Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator. For more information about or to do calculations involving APR, please visit the APR Calculator.

Compounding Frequency

Compound interest is interest that is earned not only on the initial principal but also on accumulated interest from previous periods. Generally, the more frequently compounding occurs, the higher the total amount due on the loan. In most loans, compounding occurs monthly. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest.

Loan Term

A loan term is the duration of the loan, given that required minimum payments are made each month. The term of the loan can affect the structure of the loan in many ways. Generally, the longer the term, the more interest will be accrued over time, raising the total cost of the loan for borrowers, but reducing the periodic payments.

Variables involved

For any typical financial investment, there are four crucial elements that make up the investment.

Return rate – For many investors, this is what matters most. On the surface, it appears as a plain percentage, but it is the cold, hard number used to compare the attractiveness of various sorts of financial investments.

Starting amount – Sometimes called the principal, this is the amount apparent at the inception of the investment. In practical investing terms, it can be a large amount saved up for a home, an inheritance, or the purchase price of a quantity of gold.

End amount – The desired amount at the end of the life of the investment.

Investment length – The length of the life of the investment. Generally, the longer the investment, the riskier it becomes due to the unforeseeable future. Normally, the more periods involved in an investment, the more compounding of return is accrued and the greater the rewards.

Additional contribution – Commonly referred to as annuity payment in financial jargon, investments can be made without them. However, any additional contributions during the life of an investment will result in a more accrued return and a higher end value.

Definitions

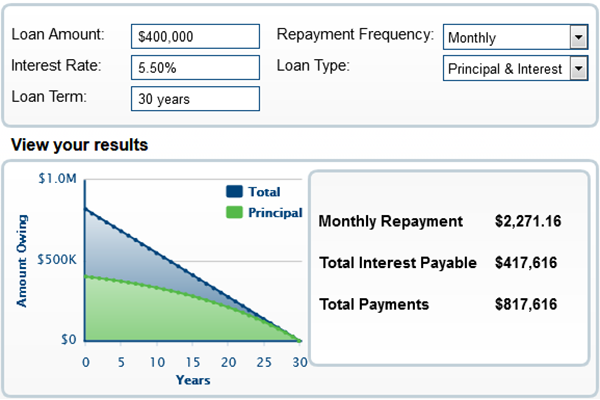

Loan amount -This is the total loan amount you are planning on taking out. This amount is also used as the initial value of the appreciable asset or investment that you are making.

Loan term in years- The number of years you wish to analyze for this loan. This can be any number from one to 30 years.

Loan interest rate - The annual interest rate you are charged for this loan. This calculator assumes that your payments are made monthly and that interest is compounded monthly.

Equations and Data Items

- Comments

- Attachments

- Stats

https://www.vcalc.com/calculator/?uuid=2cdb012e-5e62-11ed-9be9-bc764e203090 |