Tags | |

UUID | 825cd868-3ce0-11e4-b7aa-bc764e2038f2 |

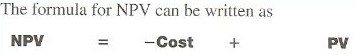

The Net Present Value of Investment (NPV) evaluates a capital investment by discounting the future cash flows to their present values and subtracts the amount of the initial investment from their sum. NPV is used to analyze an investment decision. This will give the company an idea whether or not the investment will add value to the company. If an investment has a positive NPV, it will add value to the company. If an investment has a negative NPV, it will not add value to the company.

Input Variables:

C_1 - Cash flow

r- Rate of return

C - Cost

Output for the Formula:

Returns the Net Present Value of Investment

Notes

Discounting represents the present value of a future cash flow.

This equation, Net Present Value of Investment, references 2 pages

Equations and Data Items

- Comments

- Attachments

- Stats

No comments |

This site uses cookies to give you the best, most relevant experience. By continuing to browse the site you are agreeing to our use of cookies.