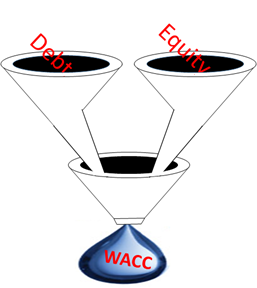

The Weighted Average Cost of Capital (WACC) equation computes the average amount (of each dollar ) that a company uses to purchase assets and what the company needs to earn on its investment dollars to maintain its current level of wealth.

Input Variables:

- E - Market Value of the Firm's Equity

- D - Market Value of the Firm's Debt

- `R_e` - Cost of Equity

- `R_d`- Cost of Debt

- `t_C`- Corporate Tax Rate

Output for Formula: Returns the Average Cost of Capital

DEFINITION

|

The WACC represents a firm's cost of capital, the cost per dollar to maintain their present corporate valuation. The cost of each category of capital is proportionately weighted. All capital sources, including common stock, preferred stock, bonds and any other long-term debt, are included in the WACC. Increased WACC indicates decreased valuation and increased risk. USAGEAverage cost of capital is usually referred to as the weighted average cost of capital because it weighs the cost of equity and the cost of debt. If you track the WACC month-to-month, you can use it as an indicator of increased risk and devaluation of the company. |