The Cost of Goods Sold calculator computes the cost based on the value of the beginning inventory, the cost of goods purchased and the value of the ending inventory.

INSTRUCTIONS: Choose units and enter the following:

- (BI) This is the Beginning Inventory

- (CoGP) This is the Cost of Goods Purchased

- (EI) This is the Ending Inventory

Cost of Goods Sold (CoGS): The calculator returns the cost in US dollars. However this can be automatically converted to compatible units via the pull-down menu.

The Math / Science

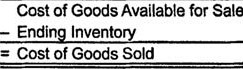

Cost of Goods Sold is simply the difference between the cost of goods available for sale and the ending inventory. The direct costs attribute to the production of the goods sold by a company. This amount includes the cost of the materials used in creating the good along with the direct labor costs used to produce the good. COGS is the costs that go into creating the products that a company sells; therefore only costs included in the measure are those that are directly tied to the production of the products. The formula for cost of goods sold is:

CoGS = BI+CoGP - EI

where

- CoGS - Cost of Goods Sold

- BI - Beginning Inventory

- CoGP - Cost of Goods Purchased

- EI - Ending Inventory

Retail Calculator

- Average Inventory is computed by dividing the sum of the merchandise inventory taken during one year by the number of such inventories.

- Asset(/Stock) to Sales Ratio is used to compare how much in assets a company has relative to the amount of revenues the company can generate using their assets.

- Quick Ratio aka Acid Test is a liquidity ratio that measures the ability to pay short-term liabilities with cash and assets quickly convertible to cash.

- Break-Even Analysis equation shows the point in business where the sales equal the expenses.

- Cost of Goods Sold is simply the difference between the cost of goods available for sale and the ending inventory.

- Gross Profit is the difference between the net sales (or revenue) and the cost of goods or services sold. It is also known as the gross margin or Sales profit.

- Gross Profit Percentage is the difference between the net sales and the cost of goods sold (or services rendered) divided by the net sales times a hundred.

- Gross Profit Margin measures how much of each sales dollar is used to finance the direct inputs required to manufacture or merchandise the product sold.

- Gross Margin Ratio equation is used to compute the profitability of a company on selling its inventory or merchandise.

- Gross Margin Return on Investment [GMROI] calculation can be used to measure the performance the entire shop, but it is more effective if used for a particular department or category of merchandise.

- Inventory Turnover Ratio reveals how many times inventory turns over (is sold and replaced) in a period.

- Initial Markup % is the comparison of the amount of money, expressed as a percentage of initial cost, that a retailer adds to the price of goods.

- Maintained Markup reveals the impact of markdowns (reductions) on the Initial Markup.

- Maintained Markup Percentage is the percentage of net sales.

- Markup is the difference between cost of a good or service and its selling price.

- Net Sales is the sales revenue less sales returns and allowances and sales discounts.

- Open-To-Buy is the difference between how much inventory is needed and how much is actually available.

- Reductions are the combined cost of making a specified product/service cheaper or less in amount.

- Retail Price is the price at which the manufacturer recommends that the retailer sell the product.

- Sales per Square Foot is most commonly used for planning inventory purchases.

- Sell-Through Rate/Analysis is the selling activity of a product within a defined period of time.

- Total Stock Return is the appreciation in the price plus any dividends paid, divided by the original price of the stock.